In Focus: Growth priority – Chemicals

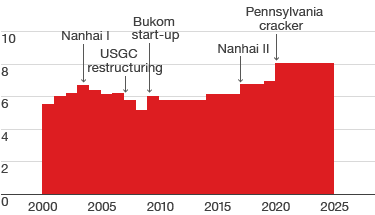

Ethylene capacity

Million metric tonnes

Chemicals is now a growth priority for Shell. Petrochemicals is the fastest growing hydrocarbon demand sector with annual growth of 3.7% over the last 10 years, and we expect this to continue. Shell’s Chemicals strategy focuses on activities with a clear competitive advantage. We optimise returns from using different feedstocks, invest in our existing first-class footprint, and continue to focus on enhancing our customer relationships and service. With a competitive edge in chemical feedstocks, underpinned by a strong product portfolio and proprietary Shell technology, the business is entering a new period of growth.

For example, in the US Gulf Coast, we decided in Q4 2015 to expand our chemical footprint at the manufacturing site in Geismar, Louisiana, which will make the site the largest alpha olefins producer in the world. The chemical site is used in the production of stronger and lighter polyethylene plastic for packaging and bottles, as well as engine and industrial oils and drilling fluids.

In China, Shell and CNOOC took the FID in the first quarter of 2016 to expand an existing petrochemical complex at Nanhai. The project will increase ethylene capacity by more than 1 million tonnes per year, doubling the current capacity. The complex currently converts a variety of liquid feedstocks into olefins and derivative products. These are used in a wide range of consumer goods, including computers, plastic bottles and washing liquids.

In 2016, we announced the FID on a new, 1.5 million tonnes per annum ethylene cracker and polyethylene plant in Pennsylvania, USA, which will use natural gas from shales production as its feedstock to produce polyethylene. Polyethylene is used in many products, from food packaging and containers to automotive components.

It will be one of the most cost competitive polyethylene producers in the USA and will have three components of competitive advantage over US Gulf Coast investments. Firstly, it will use locally-sourced ethane with a supply cost advantage. Secondly, it will have the advantage of being located in the centre of US polyethylene demand. Thirdly, it will be eligible for economic development, job creation and investment incentives from the State of Pennsylvania. The main construction will start in 2018, as we manage capital affordability in the current low oil price environment. Commercial production is expected to begin early in the next decade.

We will continue to focus on selective and prudent investments with a competitive advantage to ensure profitable growth in the future.