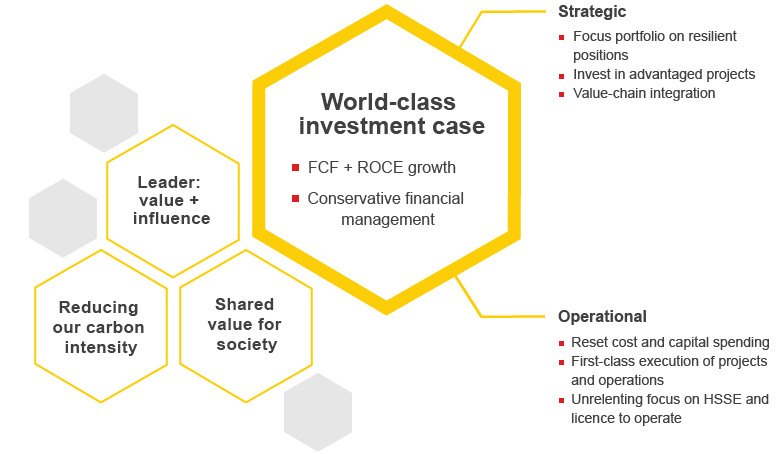

Strategy

Our strategy seeks to create a world-class investment case for shareholders. This strategy is underpinned by Shell’s outlook for the energy sector and the need to adapt to substantial changes in the world around us. Rising global population and standards of living should continue to drive demand growth for oil and gas for decades to come. At the same time, there is a transition underway to a lower-carbon energy system; a world with increased customer choice; continued energy price volatility; and, with the advent of low-cost shale reserves, a new dynamic in value creation in oil and gas. Safety and environmental and social responsibility are at the heart of our activities. The ability to achieve our strategic objectives depends on how we respond to competitive forces.

We continuously assess the external environment – the markets as well as the underlying economic, political, social and environmental drivers that shape them – to anticipate changes in competitive forces and business models. We undertake regular reviews of the markets we operate in and analyse our competitors’ strengths and weaknesses to understand our competitive position. We maintain business strategies and plans that focus on actions and capabilities to create and sustain competitive advantage.

Strategic ambitions

Against this backdrop, Shell has the following strategic ambitions:

- to create a world-class investment case by reshaping Shell to grow free cash flow and increase returns, all underpinned by a conservative financial framework;

- to reduce our carbon intensity as part of the energy transition;

- to maintain a position of leadership and influence in our industry and to have the largest value share among our competitors; and

- to create shared value for society.

We have defined our strategy to deliver against these long-term ambitions and believe that success will lead to sustaining a world-class investment case.

Portfolio and priorities

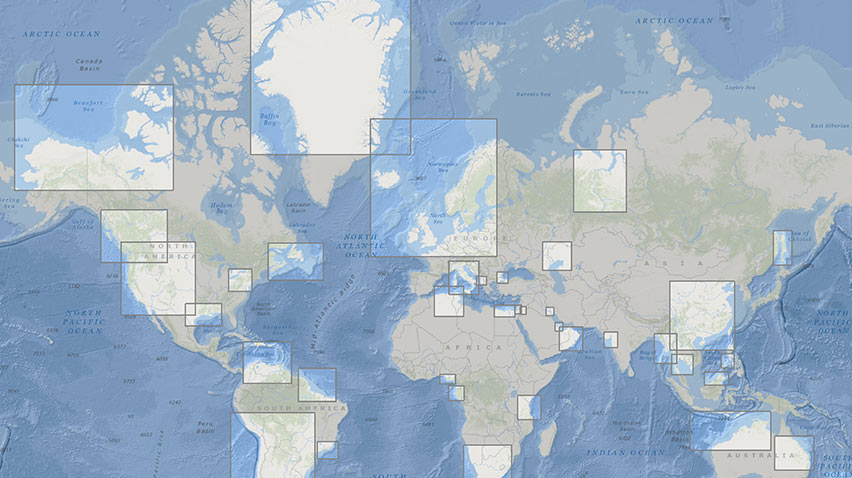

We focus on a series of strategic themes, described in categories of cash engines, growth priorities and future opportunities – each requiring distinctive technologies and risk management.

Through all of our strategic themes, our intention is to be in fundamentally advantaged and resilient positions. We allocate capital to each of these strategic themes to drive an optimal cash flow and returns profile over multiple timelines. When we set our plans and goals, we do so on the basis of delivering sustained returns over decades.

We aim to leverage our diverse and global business portfolio and customer-focused businesses built around the strength of the Shell brand.

Investment priorities

Cash engines: Today

- Funds dividends + balance sheet

- Competitive + resilient

- Strong, stable returns and free cash flow

Conventional oil and gas

Integrated Gas

Oil Products

Growth priorities: 2016+

- Cash engines 2020+

- Affordable growth in advantaged positions

- ROACE + free cash flow pathway

Deep water

Chemicals

Future opportunities: 2020+

- Material value + upside

- Path to profitability

- Managed exposure

Shales

New Energies