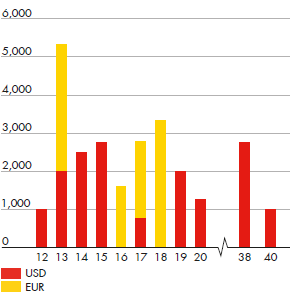

$ million equivalent

Publicly traded bonds were issued by Shell

International Finance BV and guaranteed by Royal Dutch Shell plc. Shell International Finance BV is a 100% subsidiary of Royal Dutch Shell plc.

| Download XLS |

|

CREDIT RATINGS (AT 31 DECEMBER 2011) |

|

|

|

| |||

|

|

S&P |

|

Moody’s | ||||

|

|

Short-term |

Long-term |

Outlook |

|

Short-term |

Long-term |

Outlook |

|

Royal Dutch Shell plc |

A-1+ |

AA |

Stable |

|

P-1 |

Aa1 |

Stable |

|

Debt of Shell International Finance BV |

A-1+ |

AA |

Stable |

|

P-1 |

Aa1 |

Stable |

| Download XLS |

|

PUBLICLY TRADED BONDS, CURRENT OUTSTANDING |

|

|

| ||||

|

Settlement |

Maturity |

Currency |

Million |

Coupon |

|

Listing |

ISIN |

|

22 Mar 2007 |

22 Mar 2017 |

USD |

750 |

5.20% |

|

New York |

US822582AC66 |

|

22 May 2007 |

22 May 2017 |

EUR |

1,500 |

4.63% |

|

London |

XSO301945860 |

|

11 Dec 2008 |

15 Dec 2038 |

USD |

2,750 |

6.38% |

|

New York |

US822582AD40 |

|

09 Feb 2009 |

09 Feb 2016 |

EUR |

1,250 |

4.50% |

|

London |

XS0412968876 |

|

23 Mar 2009 |

21 Mar 2014 |

USD |

2,500 |

4.00% |

|

New York |

US822582AF97 |

|

13 May 2009 |

14 May 2013 |

EUR |

2,500 |

3.00% |

|

London |

XSO428146442 |

|

13 May 2009 |

14 May 2018 |

EUR |

2,500 |

4.38% |

|

London |

XSO428147093 |

|

22 Sep 2009 |

22 Sep 2015 |

USD |

1,000 |

3.25% |

|

New York |

US822582AH53 |

|

22 Sep 2009 |

22 Sep 2019 |

USD |

2,000 |

4.30% |

|

New York |

US822582AJ10 |

|

25 Mar 2010 |

25 Mar 2013 |

USD |

2,000 |

1.88% |

|

New York |

US822582AL65 |

|

25 Mar 2010 |

25 Mar 2020 |

USD |

1,250 |

4.38% |

|

New York |

US822582AM49 |

|

25 Mar 2010 |

25 Mar 2040 |

USD |

1,000 |

5.50% |

|

New York |

US822582AN22 |

|

24 Jun 2010 |

22 Jun 2012 |

USD |

1,000 |

Floating |

|

New York |

US822582AP79 |

|

28 Jun 2010 |

28 Jun 2015 |

USD |

1,750 |

3.10% |

|

New York |

US822582AQ52 |