Publicly traded bonds were issued by Shell International Finance BV and guaranteed by Royal Dutch Shell plc. Shell International Finance BV is a 100% subsidiary of Royal Dutch Shell plc.

| Download XLS |

|

CREDIT RATINGS (AT 31 DECEMBER 2013) |

|

|

|

| |||

|---|---|---|---|---|---|---|---|

|

|

S&P |

|

Moody’s | ||||

|

|

Short-term |

Long-term |

Outlook |

|

Short-term |

Long-term |

Outlook |

|

Royal Dutch Shell plc |

A–1+ |

AA |

Stable |

|

P–1 |

Aa1 |

Stable |

|

Debt of Shell International Finance BV |

A–1+ |

AA |

Stable |

|

P–1 |

Aa1 |

Stable |

| Download XLS |

|

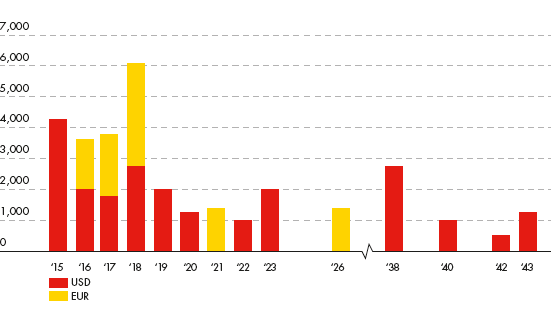

PUBLICLY TRADED BONDS, CURRENT OUTSTANDING |

|

|

| ||||

|---|---|---|---|---|---|---|---|

|

Maturity |

Settlement |

Currency |

Million |

Coupon |

|

Listing |

ISIN |

|

28 Jun 2015 |

28 Jun 2010 |

USD |

1,750 |

3.100% |

|

New York |

US822582AQ52 |

|

22 Sep 2015 |

22 Sep 2009 |

USD |

1,000 |

3.250% |

|

New York |

US822582AH53 |

|

10 Nov 2015 |

15 Nov 2013 |

USD |

750 |

3-month LIBOR +0.07% |

|

New York |

US822582BB74 |

|

04 Dec 2015 |

06 Dec 2012 |

USD |

750 |

0.625% |

|

New York |

US822582AU64 |

|

09 Feb 2016 |

09 Feb 2009 |

EUR |

1,250 |

4.500% |

|

London |

XS0412968876 |

|

15 Nov 2016 |

15 Nov 2013 |

USD |

1,000 |

3-month LIBOR +0.21% |

|

New York |

US822582BC57 |

|

15 Nov 2016 |

15 Nov 2013 |

USD |

1,000 |

0.900% |

|

New York |

US822582AZ51 |

|

22 Mar 2017 |

22 Mar 2007 |

USD |

750 |

5.200% |

|

New York |

US822582AC66 |

|

22 May 2017 |

22 May 2007 |

EUR |

1,500 |

4.625% |

|

London |

XS0301945860 |

|

21 Aug 2017 |

21 Aug 2012 |

USD |

1,000 |

1.125% |

|

New York |

US822582AR36 |

|

14 May 2018 |

13 May 2009 |

EUR |

2,500 |

4.375% |

|

London |

XS0428147093 |

|

10 Aug 2018 |

12 Aug 2013 |

USD |

1,500 |

1.900% |

|

New York |

US822582AW21 |

|

15 Nov 2018 |

15 Nov 2013 |

USD |

1,250 |

2.000% |

|

New York |

US822582BA91 |

|

22 Sep 2019 |

22 Sep 2009 |

USD |

2,000 |

4.300% |

|

New York |

US822582AJ10 |

|

25 Mar 2020 |

25 Mar 2010 |

USD |

1,250 |

4.375% |

|

New York |

US822582AM49 |

|

24 Mar 2021 |

24 Mar 2014 |

EUR |

1,000 |

1.625% |

|

London |

XS1048521733 |

|

21 Aug 2022 |

21 Aug 2012 |

USD |

1,000 |

2.375% |

|

New York |

US822582AS19 |

|

06 Jan 2023 |

06 Dec 2012 |

USD |

1,000 |

2.250% |

|

New York |

US822582AV48 |

|

12 Aug 2023 |

12 Aug 2013 |

USD |

1,000 |

3.400% |

|

New York |

US822582AX04 |

|

24 Mar 2026 |

24 Mar 2014 |

EUR |

1,000 |

2.500% |

|

London |

XS1048529041 |

|

15 Dec 2038 |

11 Dec 2008 |

USD |

2,750 |

6.375% |

|

New York |

US822582AD40 |

|

25 Mar 2040 |

25 Mar 2010 |

USD |

1,000 |

5.500% |

|

New York |

US822582AN22 |

|

21 Aug 2042 |

21 Aug 2012 |

USD |

500 |

3.625% |

|

New York |

US822582AT91 |

|

12 Aug 2043 |

12 Aug 2013 |

USD |

1,250 |

4.550% |

|

New York |

US822582AY86 |

Bond maturity profile $ million equivalent