We continuously seek to improve our operating performance, with an emphasis on health, safety and environment, asset performance and operating costs. For 2014, we have set out three key priorities: improving our financial performance, enhancing our capital efficiency, including financial discipline when evaluating investment opportunities, and continuing our focus on project delivery.

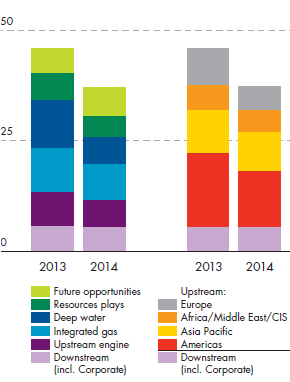

In 2014, we expect capital investment of around $37 billion, a reduction of $9 billion compared with 2013, as we moderate our growth ambitions and strive to improve our free cash flow and returns. Asset sales are a key element of our strategy – improving our capital efficiency by focusing our investment on the most attractive growth opportunities. Sales of non-core assets in 2011 to 2013 generated $16 billion in divestment proceeds. Exits from further positions in 2014 to 2015 are expected to generate some $15 billion in divestment proceeds. We have initiatives underway that are expected to improve our Upstream Americas and integrated Downstream businesses, focusing on the profitability of our portfolio and growth potential.

Shell has built up a substantial portfolio of project options for future growth. This portfolio has been designed to capture energy price upside and manage Shell’s exposure to industry challenges from cost inflation and political risk. Key elements of these opportunities are in global exploration and established resources positions in the Gulf of Mexico, Australian LNG, offshore Europe, and others. Shell is working to mature these projects, with an emphasis on financial returns.

The statements in this Strategy and outlook section, including those related to our growth strategies and our expected or potential future cash flow from operations, capital investment, divestment proceeds, and production, are based on management’s current expectations and certain material assumptions and, accordingly, involve risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied herein.

2014 priorities

Total capital investment $ billion

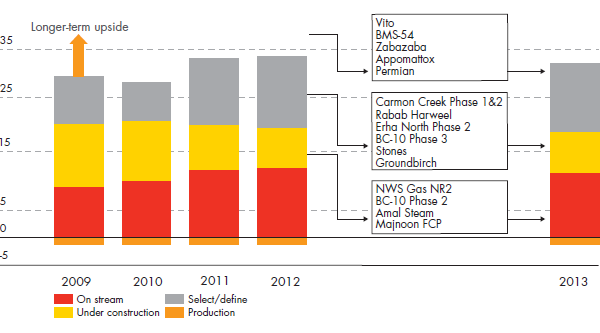

Converting resources to production billion boe

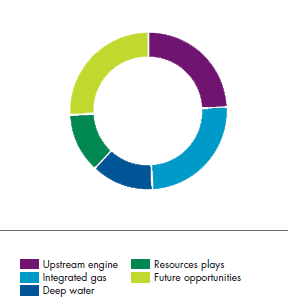

2013 resources by strategic theme

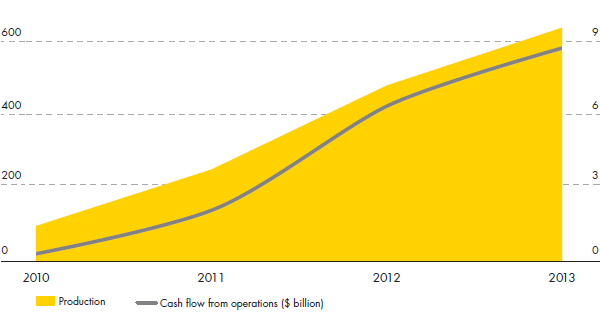

Production growth from key start-ups kboe per day $ billion

|

KEY UPSTREAM PROJECT START-UPS | |||||

|---|---|---|---|---|---|

|

2010 |

2011 |

2012 |

2013 |

2014 | |

|

|

|

|

|

|

|

| |||||