Integrated Gas overview

In 2015, our Integrated Gas business

- Earnings, excluding identified items for the full year 2015, were $5.1 billion.

- In Malaysia, the LNG Dua Joint Venture Agreement (JVA) expired and we transferred our 15% shareholding to PETRONAS, in accordance with the original JVA terms. With the expiry of the LNG Dua production-sharing contract (PSC), we handed over the operatorship.

- In the USA, we sold our 49% interest in Elba Liquefaction Company, LLC, the owner of the Elba Liquefaction Project to Kinder Morgan, Inc., resulting in Kinder Morgan owning 100% of the Elba Liquefaction Company, LLC. We retain the rights to 100% of the liquefaction capacity through a tolling arrangement, once construction is complete. Elba Island also has an existing regasification terminal where Shell has contracted firm capacity. Shell’s current contracted capacity is 11.6 million tonnes per annum (mtpa).

So far in 2016

- In Australia, production of LNG and condensate started at the Gorgon LNG project on Barrow Island, off the northwest coast, in March 2016.

- In Australia, the Browse Joint Venture participants (Shell interest 27%) decided not to progress with the development concept being studied for the resource as it did not meet commercial requirements for a positive FID, considering the current economic and market environment.

- INPEX as operator of the Abadi field in Indonesia (Shell interest 35%) received a notification from the regulator SKK Migas requesting INPEX to resubmit a revised plan of development based on onshore LNG rather than floating LNG.

- Sabine Pass LNG, the first LNG export terminal in the US, started up in February. As one of the first to off-take from this terminal, Shell is well-positioned to take advantage of the new wave of LNG supply expected from the US.

- In New Zealand, we sold our 83.75% interest in the Maui natural gas pipeline to First State Investments for a consideration of around $0.2 billion. The transaction was completed in June 2016.

|

Integrated gas key statistics [A] | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

2015 |

2014 |

2013 |

2012 |

2011 | ||||||

|

|||||||||||

|

Earnings ($ million) |

3,170 |

10,610 |

8,998 |

10,990 |

7,280 |

||||||

|

Earnings excluding identified items ($ million) |

5,057 |

10,332 |

8,999 |

9,414 |

6,419 |

||||||

|

Cash flow from operations ($ million) |

7,728 |

12,689 |

12,273 |

10,930 |

7,666 |

||||||

|

Liquids production (thousand b/d) [B] |

204 |

221 |

224 |

138 |

110 |

||||||

|

Natural gas production (million scf/d) [B] |

2,469 |

2,666 |

2,557 |

1,961 |

1,398 |

||||||

|

Total production (thousand boe/d) [B][C] |

631 |

682 |

665 |

476 |

351 |

||||||

|

LNG liquefaction volumes (million tonnes) |

22.6 |

24.0 |

19.6 |

20.2 |

18.8 |

||||||

|

LNG sales volumes (million tonnes) |

39.2 |

39.5 |

30.5 |

30.6 |

27.7 |

||||||

|

Capital investment ($ million) |

5,178 |

9,124 |

11,822 |

6,077 |

4,783 |

||||||

|

Capital employed ($ million) |

62,481 |

62,127 |

60,657 |

47,561 |

43,813 |

||||||

|

Employees (thousands) |

13 |

11 |

10 |

N/A |

N/A |

||||||

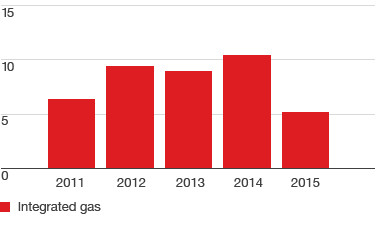

Integrated Gas earnings [A]

$ billion

[A] Excluding identified items.

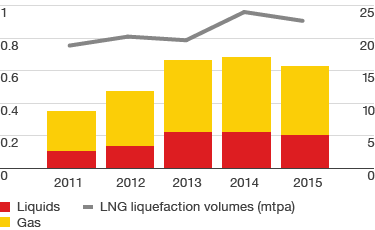

Production

million boe/d

mtpa