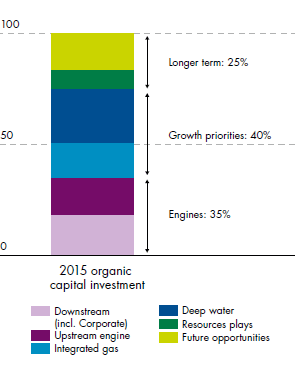

Engines

Downstream engine

The Downstream engine benefits from integrating our Trading & Supply, Pipelines, Refining, Chemicals and Marketing businesses to optimise the value of molecules across the supply chain. Our emphasis remains on sustained cash generation from our existing assets and selective growth investments. This will be delivered by: developing and sustaining our competitive advantage through advantaged feedstock and supply; improving our footprint; differentiated products and customer offer; and a distinguished brand. This is possible thanks to our diverse mix of world-class professionals and competitive technology, underpinned by our strong HSSE performance, operational excellence, strong project delivery and capital discipline.

Upstream engine

Shell’s Upstream engine focuses on cash generation from our mature basins. Focused exploration, licence renewals and the application of Shell’s advanced technology will all contribute to extending the life of these assets in a safe and responsible manner. Our positions in Europe, South-east Asia and parts of the Middle East are included in the Upstream engine and should underpin the financial performance of our Upstream businesses through to the end of the decade.

Growth priorities

Integrated gas

Shell is the leading international oil company in integrated gas, which comprises LNG and GTL. Our integrated gas business generated earnings of more than $10 billion in 2014 (about 45% of total group earnings) and cash flow from operations of $13 billion (about 30% of the group total). We have around 26 million tonnes per annum (mtpa) of equity LNG capacity on-stream today and we expect further substantial growth once Gorgon, Prelude and other projects are on stream. We pursue trading and arbitrage activities in the global LNG portfolio, thereby adding more value to the bottom line in this important growth business.

Deep water

Shell is a deep-water oil and gas industry pioneer, with our production rising to around 390 thousand boe/d in 2014 and further growth expected over the next few years. In 2014 we successfully started production from four Shell-operated deep-water projects – Mars B and Cardamom in the Gulf of Mexico, Bonga North West in Nigeria and Gumusut-Kakap in Malaysia.

We have six major projects under construction in Brazil, the US Gulf of Mexico, Nigeria and Malaysia.

We focus on standardising development techniques. For example, in the deep waters of the Gulf of Mexico, Shell pioneered tension-leg platform developments at the Auger field in 1993. The Olympus platform, which began producing from the Mars B development in early 2014, is our sixth and largest tension-leg platform in the Gulf of Mexico.

Longer term

Resources plays

Resources plays, such as shale oil and gas, are a potentially significant opportunity for the oil and gas industry globally. We are looking carefully where we can add value to this part of the industry.

Our resources plays today are dominated by North American gas and liquids-rich production. Outside of North America, we have shale oil and gas acreage and options in a number of countries. In total, we have such positions in 13 countries.

In 2014, we made a lot of progress with the restructuring of our North American resources plays business and we are extending this drive into our worldwide resources plays portfolio.

Future opportunities

This strategic theme covers the Arctic, Iraq, Kazakhstan, Nigeria onshore and heavy oil plays. In these areas, Shell has access to large resources positions – typically in oil – but there are issues that can slow the pace of development. These include community and government relations, security of staff and evolving local fiscal and environmental regulations. We are in these areas for their long-term potential and we expect to see a measured pace of development. In Nigeria onshore, we are restructuring our portfolio and are in the process of an asset sales programme that will see our onshore portfolio increasingly focused on the gas value chain.

Investment priorities

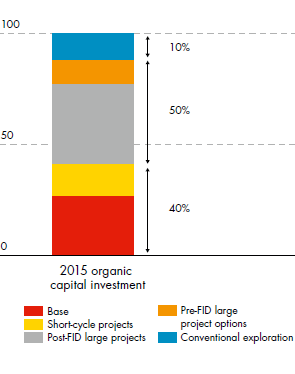

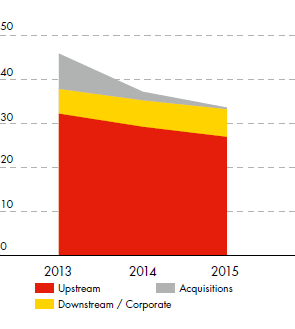

Organic capital investment%